Does Pennsylvania Require Full Coverage Car Insurance?

If you’re buying or insuring a vehicle in Pennsylvania, you might be wondering:

“Do I need full coverage?”

The answer? Not legally. But full coverage can be a smart choice depending on your vehicle, budget, and driving habits.

Let’s break down what the state actually requires, what “full coverage” really means, and how to decide what’s right for you — especially if you live in Cambria County.

Understanding Auto Insurance Requirements in PA

What’s Legally Required?

Pennsylvania is a no-fault state, which means each driver’s insurance pays for their own medical expenses regardless of who caused the accident.

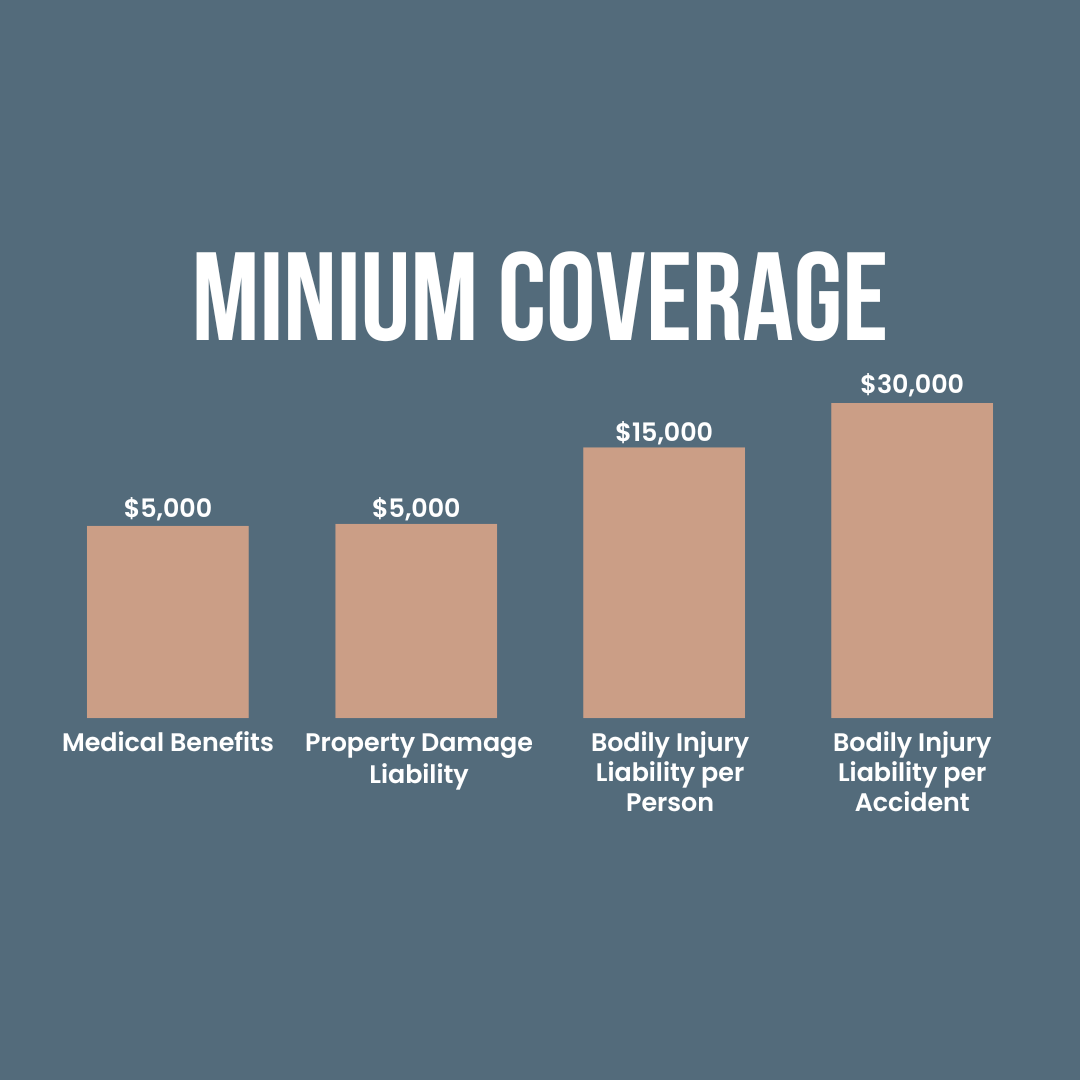

At minimum, the state requires:

$15,000 bodily injury liability per person

$30,000 bodily injury liability per accident

$5,000 property damage liability

$5,000 medical benefits (Personal Injury Protection)

These are known as minimum liability limits — and while they’re legal, they often aren’t enough to fully protect you in a serious crash.

Learn More about State Requirements.

What Is “Full Coverage”?

The term “full coverage” isn’t a specific policy — it’s a common way of referring to a combination of liability, collision, and comprehensive insurance, which together protect:

Other drivers (if you’re at fault)

Your own vehicle (damage, theft, natural events)

Yourself (through optional medical coverage or underinsured motorist protection)

What’s the Difference Between Liability and Full Coverage?

Liability Coverage Explained

Covers:

Injuries or damage you cause to others

Legal defense if you’re sued after an accident

Does not cover damage to your own car.

Collision and Comprehensive Coverage

These are what make a policy “full coverage”:

Collision: Pays for damage to your vehicle from hitting another car or object

Comprehensive: Pays for non-collision events like theft, vandalism, fire, falling trees, or animal strikes

When Full Coverage Makes Sense in Pennsylvania

Your Vehicle Is New or Valuable

If your car is worth more than $4,000–$5,000, or is less than 10 years old, full coverage can help protect your investment.

You’re Leasing or Financing

Most lenders require full coverage for leased or financed vehicles — it’s not optional in these cases.

You Drive in High-Risk Conditions

Cambria County drivers face:

Snowy roads

Wildlife collisions

Rural highways

Full coverage can ease the cost of unexpected damage in these situations.

When Liability-Only Might Be Enough

Your Vehicle Is Older or Paid Off

If replacing your car out-of-pocket wouldn’t break the bank, you might choose to carry only liability coverage and save on premiums.

You Have a High Deductible Tolerance

If you’d rather self-insure for damage to your own vehicle, and can cover repair costs if needed, liability-only may be a calculated risk.

How to Know What You Really Need in Cambria County

The best policy isn’t always the cheapest — it’s the one that covers you based on how you live, drive, and manage risk.

At Ebensburg Insurance, we help drivers throughout Cambria County compare liability vs. full coverage based on:

Vehicle value

Driving habits

Budget

Local weather and accident trends

Lender requirements

Not sure what your current policy includes?

We’ll review it with you — no pressure, just clarity.

Request a free quote

Or schedule a quick coverage check with our local team

Serving Ebensburg, Bellwood, Carrolltown, Northern Cambria, and surrounding areas.